In the middle of the night, my phone rang. It was a distraught older relative, who was worried she was about to be arrested. Scammers had threatened her, saying there was unusual activity in her bank account, and they needed to “verify” if she was breaking the law. I told her to ignore these kinds of calls, but the damage had been done. They had convinced her to share her banking information and passwords.

Every year, seniors lose millions of dollars to scams. In fact, fraud is the number one crime against our senior population. In recent months, Canadian law enforcement and banks have stepped up their efforts to address this issue by establishing safety campaigns for families.

So, what are some of the key warning signs of a scam, and how can we protect vulnerable older adults from unscrupulous scam artists?

TARGETING SENIORS

Seniors fall victim to various scams for many reasons. They often have more disposable income, making them a target. They tend to spend more time alone at home, and loneliness can make it more likely they will answer the door or the phone. They may not be familiar with technology, and so easily fall for a scammer’s ruse.

A scam happens when somebody gains your trust for the purpose of stealing your money or personal information. Scammers often use sophisticated lies to trick people. They are experts at imitating honest people or organizations. They may also threaten the victim with a fine, disconnection of services, arrest or even deportation, causing great anxiety. Scams are designed to play on emotions, such as loneliness, fear or greed, and calculated to provoke an immediate response.

Seniors must also know that it is okay to ask for help.

Fraud usually happens when somebody gains access to your funds without your knowledge or authority. You might not even be aware of the fraud until you notice discrepancies on your bank statement or receive a call from your financial institution.

WARNING SIGNS

Although scams and fraud can take many forms, there are some key warning signs. These unconscionable tricksters will suggest there is an urgency to take action or send money, suggesting that this is a “time-limited offer.” The pressure to make decisions quickly is meant to isolate individuals from the caution and concern of their family members.

Another key warning sign is the request for personal or sensitive information, such as a birth date, address, bank account information or social insurance number. Sharing this information with the wrong people will put loved ones at risk.

Other things that should ring alarm bells are contractors who ask for money upfront, a business card with no address or a company with no listing in the Better Business Bureau. These individuals will not be able to provide trustworthy references or may pressure the vulnerable adult to sign a contract on the spot.

Finally, a new area of concern is the use of artificial intelligence (AI). As AI rapidly develops and voice-cloning tools become readily available, it is crucial to help the whole family verify the identity of callers, particularly when it seems someone is in a hurry or needs information urgently.

One practical yet effective strategy is to establish a “safe word” or pre-established code to confirm a caller’s identity during a conversation. Choose a unique, memorable word or phrase, and share it only with trusted individuals.

TALK ABOUT IT

It’s important to start a conversation with the seniors in your life about how they can protect themselves. Awareness is key to recognizing scams when they show up on our doorsteps or our computers. Explain the types of scams specifically targeting them through phone calls, emails, text messages, social media and even letters in the mail. Encourage them to keep an eye on their finances and to review their bank account activity.

Seniors must also know that it is OK to ask for help. Remind them that if something seems strange or too good to be true, it is wise to ask a trusted individual to validate the request or transaction.

Most of all, it’s important for seniors, and all Canadians, to shake off the stigma that comes with being defrauded. Many of these crimes go unreported because the victims feel ashamed that they fell for the scam or did not realize they had been deceived until it was too late. It’s important to educate and reassure loved ones that anyone can be vulnerable to a well-crafted scam.

Raising awareness of this safety issue is vital to protect the lives of those we love. We all have a role to play in recognizing a potential crime or in knowing how to reduce or remove the risk of being duped into losing our financial security and peace of mind. Let’s ensure that we are aware of resources to help seniors and their families navigate these challenges.

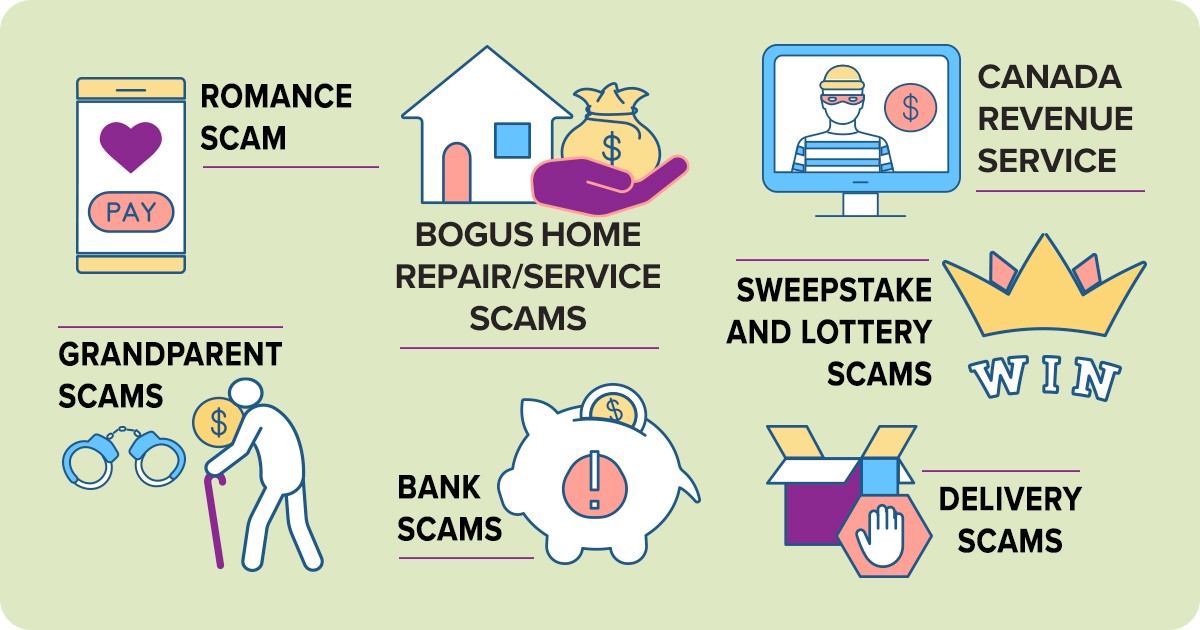

COMMON SCAMS

The first step in protecting the seniors or vulnerable family members in your life is to be aware of the most common scams. Here are a few:

Romance Scams

Loneliness plays a key role. If your parents or grandparents spend most of their time alone or isolated, they might be excited to get a phone call, email or instant message from someone keen to discuss current events and hear about their day—even if it’s a stranger. These so-called “romance scams” target older adults who are socially isolated.

Grandparent Scams

Some scammers will pose as grandchildren, texting because they’re in trouble and need cash to get out of jail or pay a fine. This type of scam has grown exponentially over the last year and is referred to as the “grandparent scam.”

Bank Scams

The senior will receive a phone call from the “bank” asking for help in solving a fraud, suggesting that they visit the bank to withdraw money and deposit into another account to see if the bank teller is honest. There is always a promise to return their money with a “payment” for their “undercover assistance.”

Bogus Home Repair/Service Scams

Random people dressed as contractors knock on the door to say they were in the neighbourhood and noticed that the roof or driveway needs repair. They will often suggest that the situation is dangerous and must be repaired immediately. They say they have a “special deal” for seniors, but the rate will increase very soon. The worker will provide the victim with a “business card” with a cell number and no address. If the repair is booked now with a down payment for materials, they can get started right away—at the “special offer” rate. Needless to say, these scammers move on with the down payment and no work completed.

Canada Revenue Service

Scammers will call, text and email pretending to be from the Canada Revenue Agency, law enforcement or the bank—some will even demand that fines or ransom should be paid in bitcoin. These calls should raise red flags as the tone is urgent in nature and oftentimes threatening.

Sweepstake and Lottery Scams

The victim receives the good news that they have won a prize through a sweepstake or lottery. They only have to pay the taxes and processing fees to receive their winnings. The scammer will often request a credit card number so they can ensure “quick payment” for both. Requests for fees or taxes to process the “prize winnings” are never above board.

Delivery Scams

The victim will receive a call or text that there is a package to be delivered but the scammer/fraudster requests personal information to deliver a package. This scam allows for identity theft.

NANCY TURLEY is the territorial abuse advisor in the Canada and Bermuda Territory.

Photo: ArtMarie/E+ via Getty Images

Illustrations: bsd studio/stock.Adobe.com

This story is from:

Nice to hear that awareness